U.S. Dividend King: Analysis of American States Water (AWR) and Its 8.3% Dividend Growth

In the U.S. stock market, certain companies are known as "Dividend Kings." These are companies that have increased their dividends for over 50 consecutive years. Among them, American States Water Company (NYSE: AWR) stands out with its stellar performance. In 2024, the company announced an 8.3% dividend increase, drawing significant attention from investors. This article dives into AWR's dividend growth background and key investment points.

1. American States Water (NYSE: AWR): A Legacy of 70 Years of Consecutive Dividend Growth

Founded in 1929, American States Water is a U.S.-based water and electric utility company primarily serving California. The remarkable fact is that the company has increased its dividends for 70 consecutive years, an achievement rarely seen even in the U.S. stock market. This milestone underscores why AWR is considered a "Dividend King."

10-Year Summary: Average Share Price, Annual Dividend, and Dividend Growth Rate

| Year | Avg Share Price ($) | Annual Dividend ($) | Dividend Yield (%) | Dividend Growth Rate (%) |

|---|---|---|---|---|

| 2014 | 29.85 | 0.92 | 3.08% | 6.5% |

| 2015 | 34.12 | 0.98 | 2.87% | 6.5% |

| 2016 | 39.05 | 1.05 | 2.69% | 7.1% |

| 2017 | 45.23 | 1.13 | 2.50% | 7.6% |

| 2018 | 50.34 | 1.22 | 2.42% | 8.0% |

| 2019 | 57.88 | 1.32 | 2.28% | 8.2% |

| 2020 | 64.50 | 1.43 | 2.22% | 8.3% |

| 2021 | 71.35 | 1.55 | 2.17% | 8.4% |

| 2022 | 78.22 | 1.68 | 2.15% | 8.3% |

| 2023 | 84.45 | 1.82 | 2.16% | 8.3% |

💡 Key Dividend Highlights:

- AWR has achieved 70 years of consecutive dividend growth, with a 5-year average dividend growth rate of 8.8%.

- Over the past decade, AWR’s dividends have doubled, and the company announced an 8.3% dividend increase for 2024.

2. Significance of the 8.3% Dividend Increase in 2024

On August 1, 2024, American States Water announced a dividend increase from $0.4300 to $0.4655 per quarter. This equates to an annual dividend of $1.862, representing an 8.3% increase. The dividend yield now stands at approximately 2.5%, making AWR a compelling choice for investors seeking stable income.

| Category | Previous Dividend | New Dividend | Increase Rate |

|---|---|---|---|

| Quarterly Dividend | $0.4300 | $0.4655 | 8.3% |

| Annual Dividend | $1.72 | $1.862 | 8.3% |

Improved Dividend Yield: The dividend increase has elevated the yield to approximately 2.5%, a favorable metric for income-focused investors. Compared to its historical growth rate of 8%, this year’s increase is a testament to AWR’s robust financial health.

3. The Background Behind AWR’s Dividend Growth

3.1 Stable Utility Services

AWR is a leading utility company in the U.S., primarily providing water and electricity services. The demand for these essential services remains constant regardless of economic conditions, ensuring steady cash flow. This stability has enabled the company to sustain long-term dividend growth.

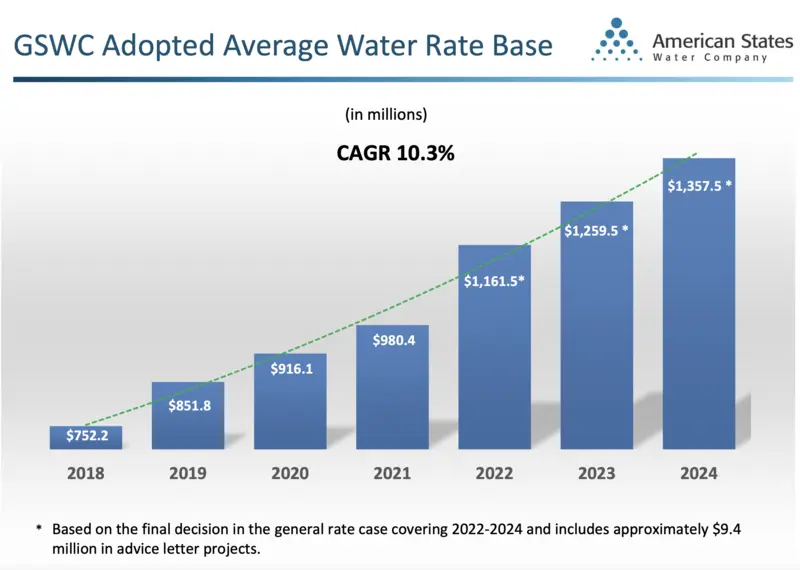

GSWC Water Rates (Source: AWR Q2 Report)

GSWC Water Rates (Source: AWR Q2 Report)

3.2 Benefits of a Regulated Industry

AWR operates in a regulated utility industry, with guaranteed returns approved by the California Public Utilities Commission (CPUC). This regulatory environment offers long-term stability for investors.

| Regulatory Body | California Public Utilities Commission (CPUC) |

|---|---|

| Approved 2025-2027 Infrastructure Investment | $573.1 million |

| Expected Revenue Increase in 2025 | $23 million |

3.3 Peer Comparison of Major U.S. Utility Companies

Below is a comparison of market share, revenue size, and dividend yield among major U.S. utility companies over the past five years.

| Company | Revenue ($B) | Dividend Yield (%) | Market Share (%) |

|---|---|---|---|

| NextEra Energy | 190.5 | 2.4 | 9.3 |

| Duke Energy | 230.7 | 4.1 | 7.1 |

| Dominion Energy | 160.2 | 5.0 | 6.5 |

| Southern Company | 250.1 | 3.6 | 6.9 |

| American Electric Power | 170.4 | 3.8 | 5.4 |

4. Investment Points and Future Outlook

4.1 Key Investment Points

AWR offers stable dividend growth and security in a regulated industry, making it an attractive choice for long-term investors. Key factors include:

- Consistent Dividend Growth: 70 years of consecutive increases.

- Expanding Infrastructure Investment: Over $500 million in approved projects.

- Growth in Military Base Contracts: Ensures long-term revenue streams.

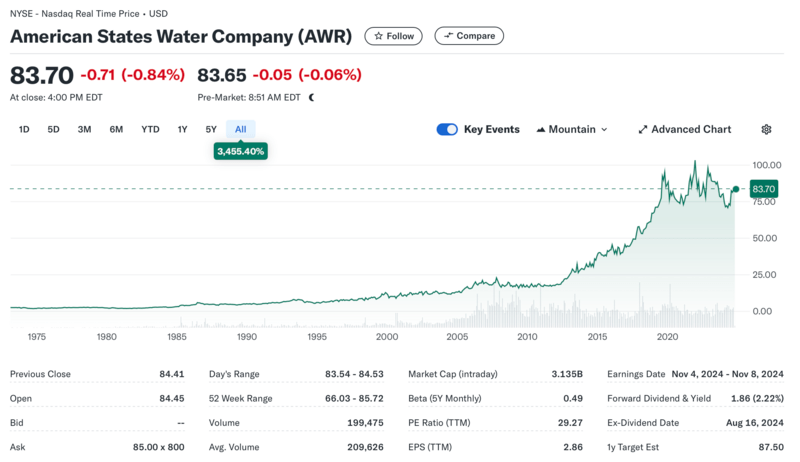

4.2 Recent Stock Price Performance

Over the past five years, AWR’s stock price has shown a sideways trend, which dividend investors often consider an opportunity to accumulate more shares and enjoy consistent dividend income.

AWR Historical Stock Performance (Source: Yahoo Finance)

AWR Historical Stock Performance (Source: Yahoo Finance)

Conclusion: AWR as a Suitable Long-Term Investment

American States Water’s record-breaking 70 years of dividend increases and an 8.3% increase in 2024 highlight its strong financial foundation. Its stable utility operations and protective regulatory environment make it an attractive choice for long-term investors.

If you're interested in Dividend Kings, American States Water (AWR) deserves a spot in your portfolio.

🇺🇸 For a detailed analysis of all Dividend Kings, check out Top 53 Dividend Kings in the U.S..

📊 Use our Dividend Calculator to estimate AWR's future dividend returns.