SCHD Q4 2024 Dividend Announcement!

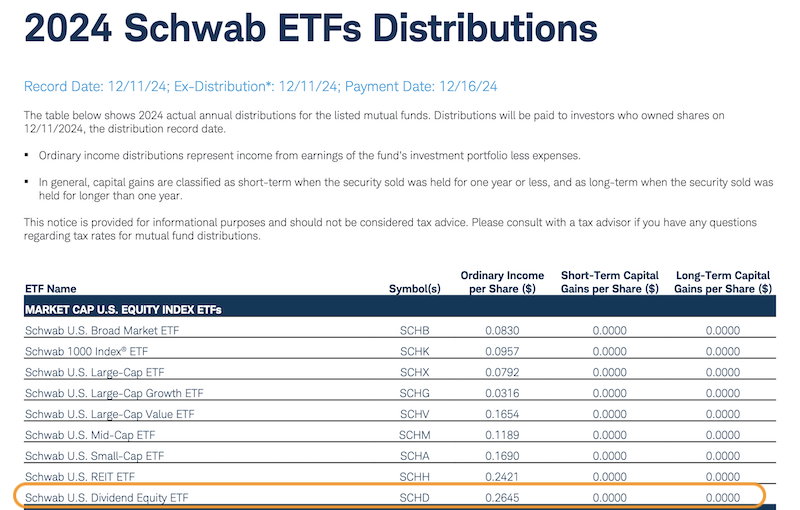

The Q4 2024 SCHD dividend has been confirmed. The dividend per share is $0.2645, with the ex-dividend date on Wednesday, December 11, and the payment date scheduled for Monday, December 16.

This represents a 6.9% increase compared to the same period last year, sending a positive signal to investors.

SCHD Q4 Dividend Announcement (Source: Charles Schwab website)

SCHD Q4 Dividend Announcement (Source: Charles Schwab website)

2024 Annual Dividend Confirmed

The total 2024 dividend for SCHD is $2.98, reflecting a 12.03% increase from the previous year, maintaining SCHD's strong dividend growth trajectory.

SCHD 2024 Annual Performance

Despite concerns in 2023 when SCHD's dividend growth rate slowed to single digits, 2024 demonstrated robust dividend growth and stable performance.

The annual dividend reached a record high, and the stock price rose 16% this year, delivering consistent returns to investors.

SCHD Annual Dividend and Growth Rates (2012–2024)

Here is a historical overview of SCHD dividends (distributions):

| Year | Annual Dividend ($) | Dividend Growth (%) |

|---|---|---|

| 2012 | 0.73 | - |

| 2013 | 0.92 | 20.48 |

| 2014 | 1.08 | 17.39 |

| 2015 | 1.15 | 6.48 |

| 2016 | 1.26 | 9.57 |

| 2017 | 1.35 | 7.14 |

| 2018 | 1.44 | 6.67 |

| 2019 | 1.76 | 22.22 |

| 2020 | 2.03 | 15.34 |

| 2021 | 2.25 | 10.84 |

| 2022 | 2.50 | 11.11 |

| 2023 | 2.66 | 6.40 |

| 2024 | 2.98 | 12.03 |

- Considering the 3-for-1 stock split in Q3 2024, the Q4 dividend multiplied by 3 contributes to the total annual dividend of $2.98 per share.

- The annual dividend yield per share at the current stock price is $0.99.

SCHD has consistently shown dividend growth.

If you had invested in 2012, your dividends would have increased nearly fourfold by now.

Key Holdings in the SCHD Portfolio (As of December 2024)

Here are the major holdings in the portfolio as of December 12, 2024.

SCHD maintains its criteria to ensure no individual holding exceeds 4%, with a total of 100 stocks.

| Symbol | Company Name | Weight (%) | Market Cap ($) |

|---|---|---|---|

| BLK | BLACKROCK INC | 4.73% | $3.1B |

| CSCO | CISCO SYSTEMS INC | 4.64% | $3.0B |

| HD | HOME DEPOT INC | 4.54% | $3.0B |

| BMY | BRISTOL MYERS SQUIBB | 4.46% | $2.9B |

| CVX | CHEVRON CORP | 4.32% | $2.8B |

| VZ | VERIZON COMMUNICATIONS | 3.98% | $2.6B |

| TXN | TEXAS INSTRUMENTS INC | 3.70% | $2.4B |

| UPS | UNITED PARCEL SERVICE | 3.68% | $2.4B |

| MO | ALTRIA GROUP INC | 3.67% | $2.4B |

| PFE | PFIZER INC | 3.50% | $2.3B |

The SCHD portfolio is composed of high-quality companies that provide stable dividend income while demonstrating significant growth potential.

2025 Outlook

SCHD is expected to maintain dividend growth and stable performance in 2025.

The high-quality dividend stocks in its portfolio promise steady income and increasing payouts.

SCHD Investor Checklist

- Ex-Dividend Date: To receive dividends, ensure you own the stock before the ex-dividend date.

- Tax Considerations: U.S. ETF dividends are subject to a 15% withholding tax, but partial refunds may apply under Korea's tax treaty.

- Long-Term Strategy: SCHD offers significant returns through reinvested dividends and compound growth over the long term.

With consistent dividend growth and a stable portfolio, SCHD remains an attractive investment option for 2025.

Investors should consider the ex-dividend date and dividend yields for informed decision-making.