Realty Income: A Reliable Dividend Stock with 2024 Q2 Performance Analysis

Realty Income is a globally recognized real estate investment trust (REIT) known for its consistent dividend payments, earning it the nickname "The Monthly Dividend Company". Listed on the New York Stock Exchange (NYSE) since 1994 under the ticker 'O', Realty Income has built a reputation for providing stable monthly dividends.

With a strong commitment to dividends, the company even highlights the benefits of dividend growth investing in its corporate materials.

Realty Income Dividend Yield Chart

Realty Income Dividend Yield Chart

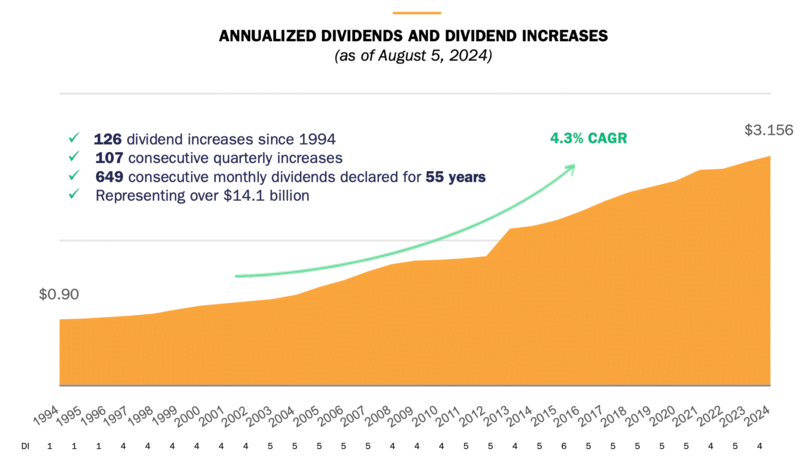

- Achieved an average annual dividend growth rate of 4.3% over 30 years.

- Paid monthly dividends consistently for 55 years.

- Increased dividends 126 times over 30 years.

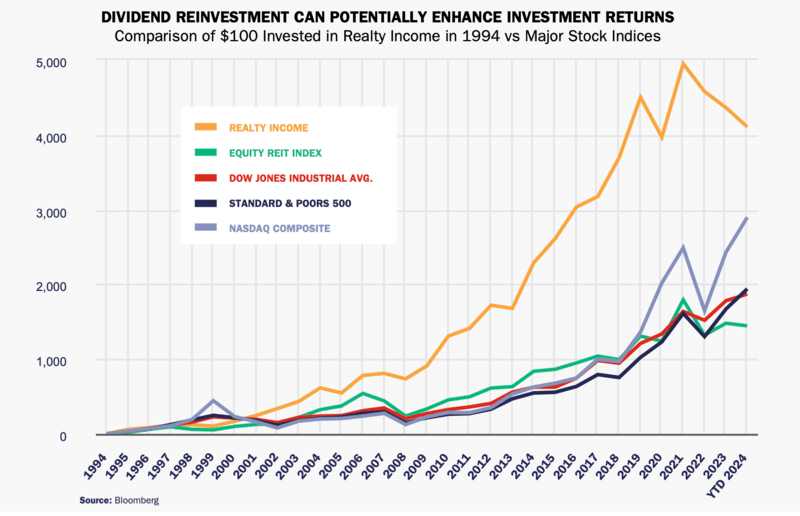

Bloomberg’s comparative performance analysis further underscores Realty Income’s appeal. Hypothetically, if dividends had been reinvested since 1994, Realty Income would have outperformed NASDAQ, S&P 500, and Dow Jones indices.

Realty Income vs. Industry Benchmarks

Realty Income vs. Industry Benchmarks

Please note, this comparison is based on historical performance and should only serve as a reference. (Source: Realty Income 2024 Q2 Factsheet)

Let’s delve deeper into the 2024 Q2 performance and future outlook of Realty Income, one of the most reliable dividend stocks.

Realty Income’s Mission

Realty Income aims to provide consistent monthly dividends, ensuring stable returns for investors. Since its founding in 1969, the company has amassed 15,450 properties worldwide, primarily focusing on commercial real estate.

Additionally, Realty Income is part of the S&P 500 Dividend Aristocrats Index, having increased its dividends annually for the past 30 years. This track record of steady dividend growth and portfolio quality management underscores its long-term success.

1. The Appeal of Realty Income as a Dividend Stock

Realty Income provides stable monthly dividends, making it highly attractive to income-focused investors. As of August 2024, the annual dividend is $3.156, offering a dividend yield of 5.2%.

- 651 consecutive months of dividend payments

- 30 years of consecutive dividend increases

- Average annual dividend growth rate: 4.3%

The table below showcases the historical dividend growth of Realty Income:

| Year | Dividend | Growth Rate |

|---|---|---|

| 1994 | $0.90 | - |

| 2024 | $3.156 | +251% |

Realty Income’s ability to deliver consistent and growing dividends over time makes it an ideal choice for long-term investors seeking stable income.

2. 2024 Q2 Performance Highlights

Realty Income’s 2024 Q2 performance demonstrated positive growth. The Adjusted Funds From Operations (AFFO) per share reached $1.06, reflecting a 6.0% year-over-year increase.

Key Performance Metrics

| Metric | Q2 2024 | YoY Change |

|---|---|---|

| AFFO per Share | $1.06 | +6.0% |

| Occupancy Rate | 98.8% | +0.3% |

| Total Investments | $805.8M | - |

| European Portfolio Yield | 8.0% | - |

What is AFFO?

Adjusted Funds From Operations (AFFO) is a key financial metric for evaluating REIT performance. Unlike net income, AFFO accounts for non-cash expenses like depreciation, offering a clearer picture of a REIT's actual cash flow.

3. Future Outlook and Investment Opportunities

3.1 Growth Potential in European Markets

Realty Income is expanding aggressively into European markets, leveraging the region’s untapped potential.

- European Portfolio: 467 assets generating ~$660M in annual rent.

- Portfolio Diversification: Assets span 43 industries, mitigating risks.

- Average Lease Term: 9.2 years, ensuring stable long-term income.

Realty Income’s European investments are supported by the following factors:

| Metric | 2024 Forecast | Details |

|---|---|---|

| European Investments | $11B | Significant growth ahead |

| Average Lease Duration | 9.2 years | Stable income expected |

| Industry Diversification | 43 industries | Portfolio resilience |

3.2 Impact of Potential Interest Rate Cuts

As a REIT, Realty Income’s performance is closely tied to interest rate trends. Potential rate cuts could positively impact its operations in the following ways:

- Lower Capital Costs: Reduced borrowing costs would enable Realty Income to acquire assets more efficiently, enhancing profitability.

- Attractive Dividend Yields: As rates decline, fixed-income alternatives become less appealing, driving more investors toward dividend-paying REITs like Realty Income.

- Increased Asset Values: Lower rates typically lead to rising real estate values, boosting Realty Income’s portfolio worth.

Conclusion: A Stable Dividend Stock for Long-Term Investors

Realty Income remains a cornerstone for income-focused portfolios, offering consistent dividend growth and high-quality assets. With a strong 2024 Q2 performance and growth opportunities in Europe, Realty Income continues to excel as both a stable and growth-oriented investment.