Broadcom (AVGO) surged past a $1 trillion market cap on December 13, 2024, with a sharp rise in its stock price.

This makes Broadcom one of the hottest leading stocks today. While its growth has been steady, let’s dive into the reasons for this December spike and future prospects.

- December 13, 2024: Stock price surged 24.43%, closing at $224.80

- December 16, 2024: Rose an additional 11.2%, closing at $250.00

Reasons Behind Broadcom’s Stock Surge

AI Semiconductor Revenue Growth - Rising as an NVIDIA Challenger

Broadcom's AI-related revenue has increased by 220% over the past year, reaching $12.2 billion in the 2024 fiscal year.

The AI semiconductor market is currently dominated by NVIDIA, but growing discontent is challenging its stronghold.

While NVIDIA's GPUs are widely regarded as "all-purpose tools," their high prices have led to dissatisfaction among customers.

In fact, NVIDIA's projected net profit margin for the 2024 fiscal year stands at a staggering 56.6%, significantly surpassing the net profit margins of its big tech clients, which range between 20% and 30%. This unusual dynamic, where a supplier enjoys far higher margins than its clients, has raised eyebrows across the industry.

Amid this environment, Broadcom is emerging as a viable alternative by offering custom chips (ASICs) tailored to the needs of big tech companies.

For instance, Google significantly reduced costs by outsourcing its TPU production to Broadcom, and TikTok’s parent company, ByteDance, has also joined Broadcom’s growing client base.

Global big tech companies, long frustrated by NVIDIA's near-monopoly in the AI semiconductor space, are likely welcoming Broadcom’s rise with open arms.

With its robust technology and reliable solutions, Broadcom is positioning itself as a strong contender in the AI semiconductor market.

| Category | Revenue Scale | Growth Rate |

|---|---|---|

| Past Year | AI-Related Revenue | 220% Increase |

| 2024 Fiscal Year | $12.2 Billion | - |

Strong Quarterly Earnings

Broadcom exceeded market expectations in its Q4 2024 fiscal results.

| Quarter | Revenue | YoY Growth | EPS |

|---|---|---|---|

| Q4 | $14.05 Billion | 51% Increase | $1.42 (Beat Est.) |

These results demonstrate how AI-driven demand and Broadcom’s expansion strategy are delivering significant returns.

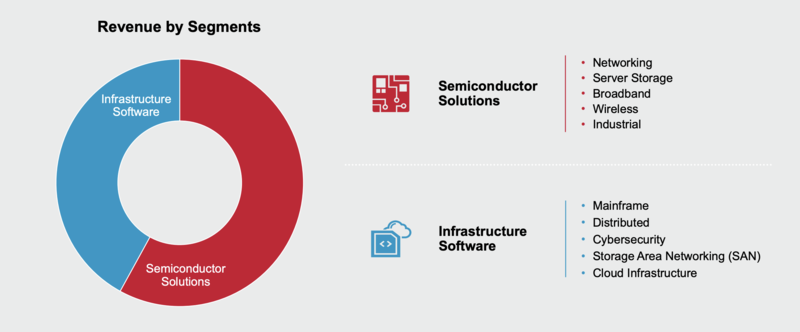

Broadcom Revenue Balance - Semiconductors vs. Software

Broadcom Revenue Balance - Semiconductors vs. Software

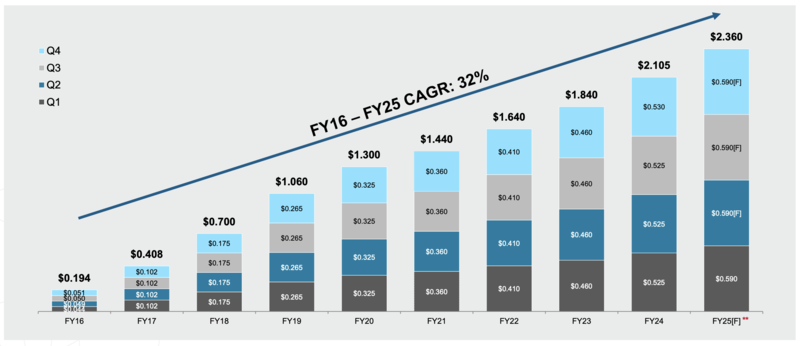

Broadcom’s Dividend Policy Analysis

Broadcom’s exceptional dividend growth is noteworthy:

Broadcom Dividend Growth Over 14 Years

Broadcom Dividend Growth Over 14 Years

2-1. Broadcom’s Dividend Yield

Broadcom remains shareholder-friendly, offering stable annual dividends.

Its current dividend yield stands at approximately 1–2%, quite high for a growth-focused tech company.

Over the past 12 years, Broadcom has consistently increased its dividends, making it attractive to long-term investors.

2-2. Recent Dividend Growth Rate and Results

Broadcom’s recent dividend growth rate hit 32%, with annual dividends steadily increasing. The 2024 annual dividend is announced at $1.105 per share, marking 12 consecutive years of growth.

2-3. Recent Dividend Details

| Period | Ex-Dividend Date | Payment Date | Dividend |

|---|---|---|---|

| Q1 | March 20 | March 29 | $0.525 |

| Q2 | June 24 | June 28 | $0.525 |

| Q3 | September 19 | September 30 | $0.525 |

| Q4 | December 15 | December 28 | $0.530 |

| 2024 Total | - | - | $2.15 |

Broadcom has achieved 12 consecutive years of dividend growth, enhancing investment stability. According to the company’s investor presentation, the 2025 dividend is projected at $2.36, reflecting ~10% growth.

AI and Dividend Growth: Two Key Strengths

3-1. Broadcom’s AI Innovation

Broadcom supports AI infrastructure with high-performance semiconductor solutions and networking equipment, driving AI market growth. Explosive demand for AI servers and cloud data centers has propelled Broadcom’s revenue and profitability.

3-2. Stable Dividends and Long-Term Appeal

Despite being a growth stock, Broadcom’s stable dividend policy adds unique value in the stock market. Long-term investors benefit from both price appreciation and consistent dividend income.

3-3. Diversified Portfolio Across Industries

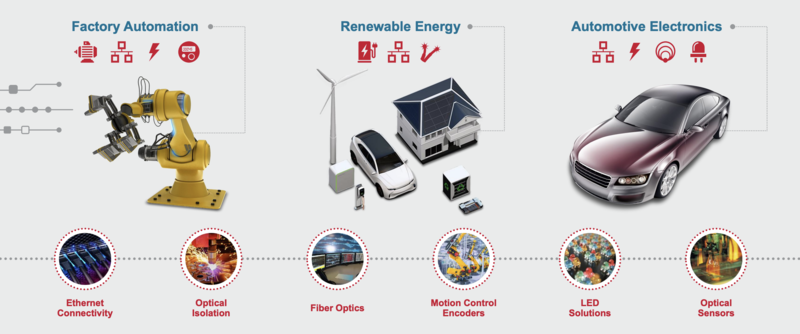

Broadcom balances hardware (semiconductors) and software solutions at a 1:1 ratio, creating a strong portfolio. This diversification across industries is a major strength:

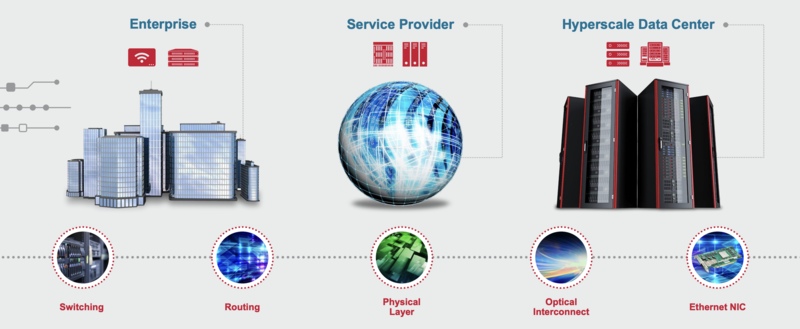

Broadcom Network Products

Broadcom Network Products

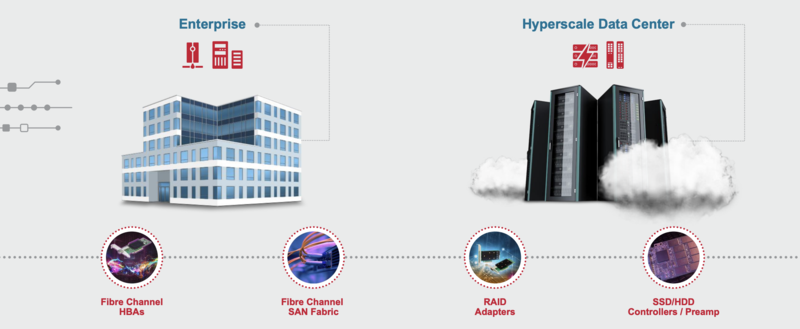

Broadcom Server and Storage Products

Broadcom Server and Storage Products

Broadcom Wireless Communication Products

Broadcom Wireless Communication Products

Broadcom Industrial Automation Products

Broadcom Industrial Automation Products

Broadcom’s Future Outlook and Investment Strategy

4-1. 2024 Performance Projections

Broadcom’s projected revenue for 2024 is approximately $45 billion. With rising AI and semiconductor demand, revenue growth is expected to exceed 10%, along with further dividend increases.

4-2. Risks to Consider

- Intensifying Competition: Strong rivals like NVIDIA and AMD

- Global Recession: Potential slowdown in semiconductor demand

- AI Dependency: Stock price volatility tied to AI market trends

Conclusion: Broadcom Remains Attractive, but Caution Needed After Recent Surge

Broadcom is a leading technology company driving AI market growth while maintaining strong dividend growth. The recent surge in its stock price reflects a combination of AI innovation and increasing dividends, making it highly favorable for long-term investors.

For those seeking both stability through dividends and future growth potential, Broadcom is a top choice. However, the recent price surge could lead to corrections, so investors are advised to monitor the stock carefully before making decisions.

🔥 Related Investor Materials: Broadcom Official Investor Presentation