BlackRock (NYSE: BLK) is one of the most prominent companies for dividend investment, attracting significant attention from investors with its stable dividend payouts and consistent growth.

This article provides an in-depth analysis of BlackRock’s 2024 dividend policy and performance, comparing it to competing asset managers and incorporating expert opinions to shape effective dividend investment strategies.

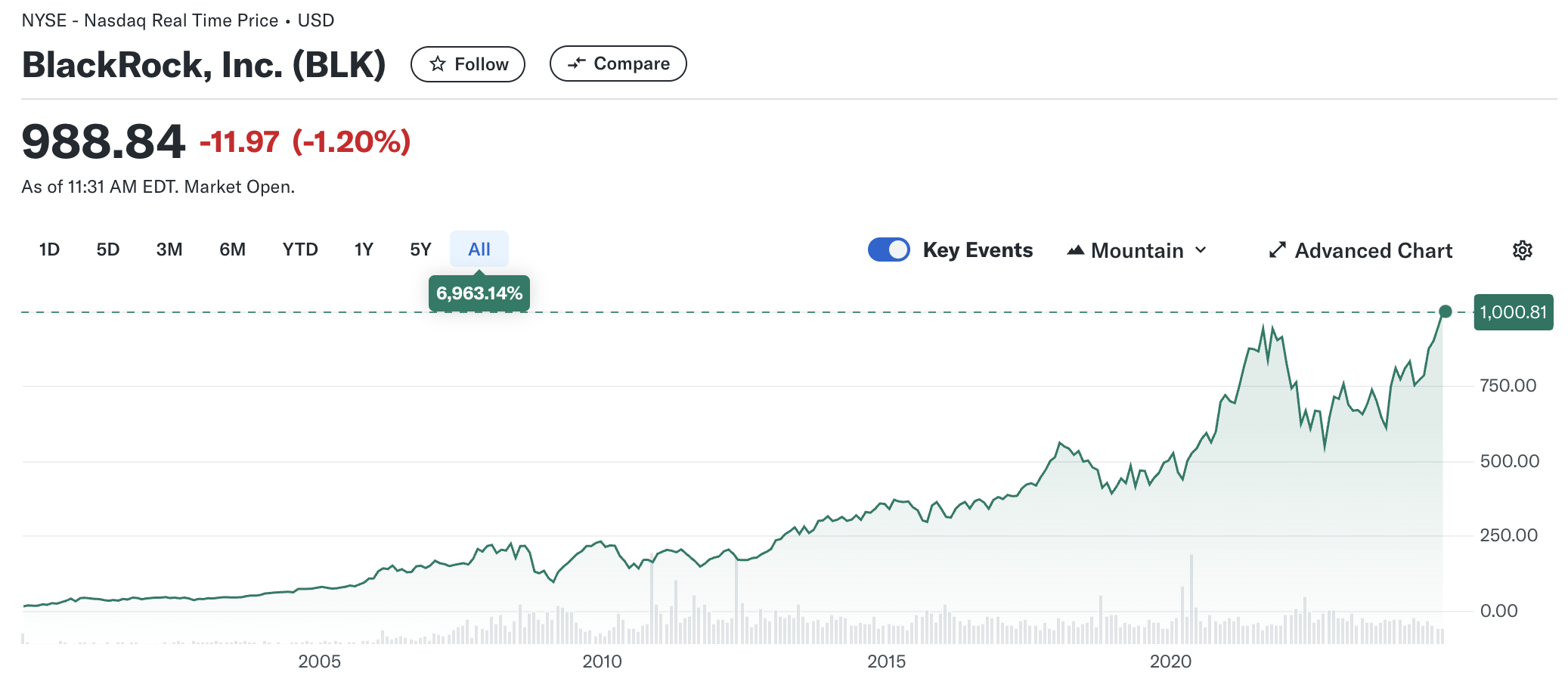

NYSE:BLK BlackRock's stock price is hitting historical highs.

NYSE:BLK BlackRock's stock price is hitting historical highs.

1. Overview of BlackRock (BLK)

1-1. Understanding BlackRock

Since its establishment in 1988, BlackRock has consistently grown to become one of the largest asset managers in the world.

As of 2024, BlackRock manages over $9 trillion in assets, making it the largest among major global asset managers.

BlackRock’s business model encompasses a diverse range of assets, including ETFs (Exchange-Traded Funds), fund management, fixed income, and alternative investments, offering optimized solutions to various investors.

1-2. Key Businesses and Asset Management Status

BlackRock’s flagship product line is iShares ETFs, which boasts the largest scale globally.

A well-known example is the IVV ETF, which tracks the S&P 500 index.

Additionally, BlackRock provides a wide range of asset management services for both institutional and individual investors, offering customized solutions tailored to investment objectives.

In 2024, BlackRock aims for continued growth, positively influencing the stability of its dividend payouts.

2. BlackRock’s 2024 Dividend Policy

2-1. Recent Dividend Details

On September 23, 2024, BlackRock announced a dividend of $5.10 per share. Annualized, the total dividend is $20.40, offering a dividend yield of 2.3% based on the current stock price of $886.43.

BlackRock’s dividend policy consistently provides stable income for investors, making it particularly attractive to long-term dividend investors.

2-2. Payout Ratio and Sustainability

BlackRock’s recent payout ratio is approximately 50% of its earnings, relatively low compared to competitors, indicating its capacity to sustain future dividend payouts.

Moreover, BlackRock has steadily increased its dividend annually for the past decade. This policy ensures stable income for investors while maintaining the company's financial health.

3. BlackRock's Long-Term Dividend Growth

3-1. Five-Year Dividend Growth Rate

Over the past five years, BlackRock has recorded an average annual EPS growth rate of 8.7% and a dividend growth rate of 12%, demonstrating its commitment to delivering increasing returns to investors.

| Year | Dividend ($) | Growth Rate (%) |

|---|---|---|

| 2020 | 14.52 | 10% |

| 2021 | 16.52 | 13% |

| 2022 | 18.32 | 11% |

| 2023 | 20.00 | 9% |

| 2024 | 20.40 | 2% |

3-2. Factors Driving Dividend Growth

To evaluate whether BlackRock can sustain its dividend growth, let’s examine three key factors:

- First, the expansion of its asset management scale.

BlackRock continues to grow its assets globally, generating significant revenue. - Second, efficiency in cost management.

Through digitalization and operational efficiency improvements, BlackRock has reduced costs, boosting its profit margins. - Third, the rising demand for sustainable investments.

With increasing demand for ESG (Environmental, Social, and Governance) investment products, BlackRock is leading in this area.

Recently, BlackRock launched active ETFs focused on AI and tech industries, ensuring it stays ahead in emerging markets.

Recently launched AI & Tech-focused ETFs by BlackRock:

- iShares A.I. Innovation and Tech Active ETF

- iShares Technology Opportunities Active ETF

4. Dividend Performance Comparison with Competitors

4-1. BlackRock vs Vanguard Group

One of BlackRock’s largest competitors, Vanguard Group, is a private company and the second-largest asset manager globally.

Vanguard is known for its low fees and long-term stability, attracting investors primarily through its ETF products.

The VOO ETF, which tracks the S&P 500, is among the world’s most popular ETFs.

While Vanguard offers stable dividends similar to BlackRock, its dividend yield is relatively lower.

In 2024, Vanguard's dividend yield stands at 1.8%, compared to BlackRock’s 2.3%.

| Asset Manager | Assets Managed | Dividend Yield | Recent Dividend ($) | 5-Year Growth Rate |

|---|---|---|---|---|

| BlackRock | $9 trillion | 2.3% | $20.40 | 12% |

| Vanguard | $7 trillion | 1.8% | $16.50 | 9% |

4-2. BlackRock vs State Street

State Street is another global asset manager, forming the top three alongside BlackRock and Vanguard.

State Street’s primary business model also revolves around ETFs, notably its SPDR ETF series.

The SPY ETF, which tracks the S&P 500, is a well-known product from State Street.

In 2024, State Street’s dividend yield is 2.0%, slightly lower than BlackRock’s.

State Street offers various products for long-term wealth accumulation and maintains a stable dividend policy.

| Asset Manager | Assets Managed | Dividend Yield | Recent Dividend ($) | 5-Year Growth Rate |

|---|---|---|---|---|

| BlackRock | $9 trillion | 2.3% | $20.40 | 12% |

| State Street | $4 trillion | 2.0% | $15.20 | 8% |

5. Expert Opinions and Market Outlook

5-1. BlackRock for Dividend Investors

Experts praise BlackRock's dividend policy as highly stable and attractive for long-term investors.

Morningstar rates BlackRock with its highest five-star rating, recommending it as an ideal stock for dividend-focused investors.

JP Morgan also projects that BlackRock will continue raising its dividends.

5-2. Future Growth Potential

Experts predict that BlackRock’s dividend growth will continue, fueled by the expanding global asset management market and trends like ESG investments. BlackRock is also leveraging AI technology to develop data-driven investment solutions, offering investors more precise services.

For a deeper understanding of BlackRock's growth potential, see ESG Investment Trends.

6. Conclusion

BlackRock remains an excellent choice for stable and high dividend performance in 2024, suitable for long-term dividend investors. Compared to competitors, BlackRock offers higher dividend yields with a stable payout ratio and strong sustainability. By leading trends like ESG investments, BlackRock is expected to achieve continuous growth. Dividend investors can include BlackRock in their portfolios to enjoy reliable dividend income.

#DividendInvesting #BlackRock #DividendGrowth #ESGInvesting #LongTermInvesting #GlobalAssetManagement